What Does a Pag-ibig Loan Form Mean?

The Pag-IBIG Fund is a government-owned corporation that helps out members by offering them affordable shelters, help from the national savings, and loans whenever a financial need is there. The loan is also known as Pag-IBIG Multi-Purpose Loan.

Besides, the process is relatively fast, with routine requests taking only two days. For a government-controlled corporation, that time frame is commendable. The people who receive this loan reside in areas struck by a disaster or calamity. The loan can be paid back at an interest rate of 5.95% per annum within 36 or 24 months.

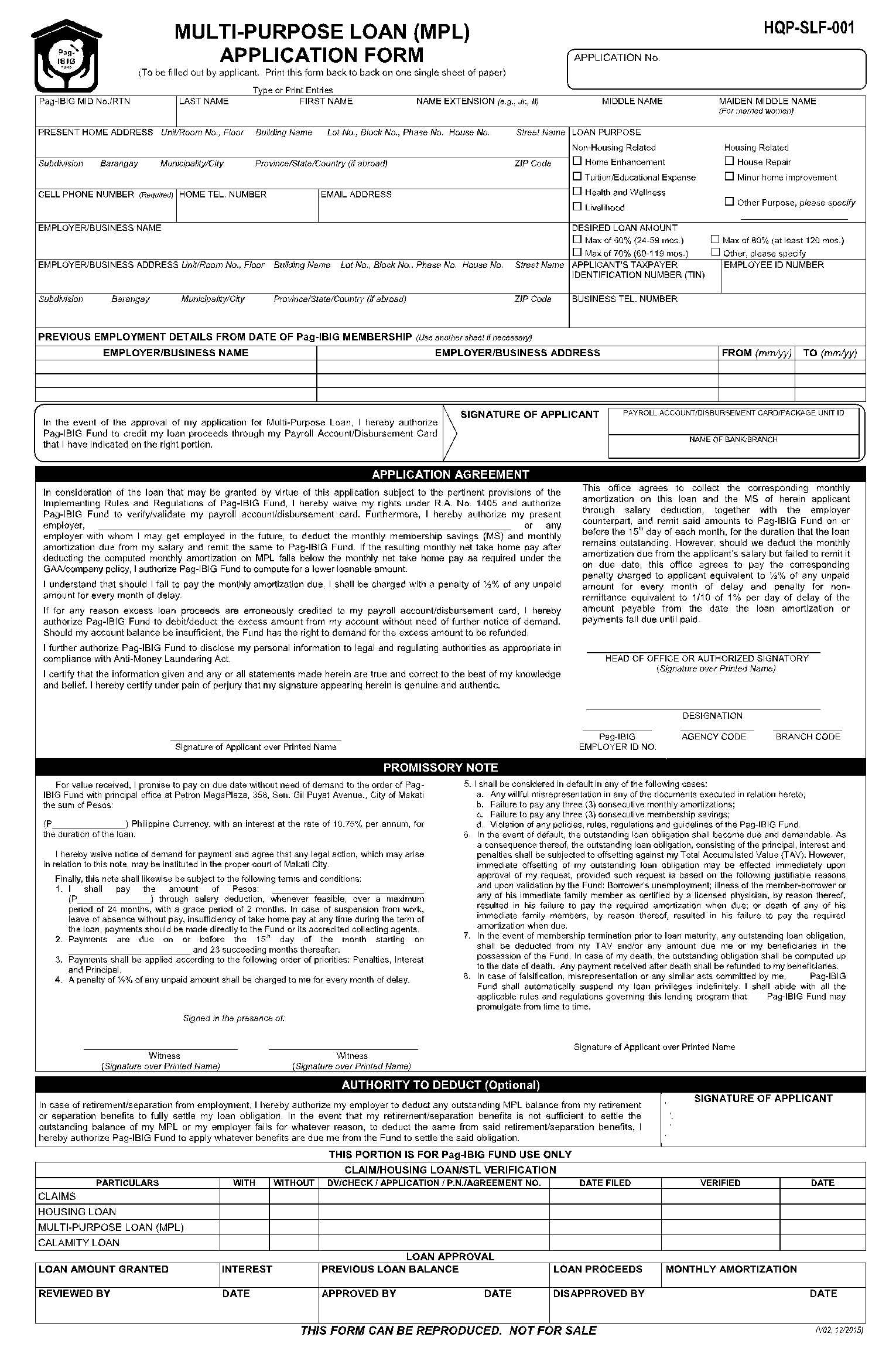

To apply for this multi-purpose loan, a Pag-ibig Loan Form 2021 is needed. We’ll go through all the information one needs to fill this form and submit their application in this article.

The complete information required on a Pag-ibig Loan Form

This is a government form, so it’s only natural that much information is required here. The form can seem overwhelming at first, but it’s divided into several sections so the applicant can easily understand it.

- Personal information

The form starts by inquiring about the applicant’s personal information, such as the first name, last name, contact details, address, subdivision, city, and postcode.

- Employer or business information

The next part of the form will ask about the applicant’s employer/business information. Details such as business name and business address are required here.

- Previous employment details

Details about previous employment are asked here, along with the relevant addresses. A limited number of fields are given by default, so a separate sheet may be used if one wishes to add more details.

- Loan Purpose

Since this form will be used to apply for a loan, the purpose of the loan will be required here. Pre-written options are given, and the applicant must tick wherever applicable. The Loan Purpose field is divided into two sections, non-housing-related loans, and housing-related loans. Here are the options offered to the applicant:

- Housing and Non-housing related

- Home Repair - (Housing)

- Minor home improvement - (Housing)

- Other Purpose (the applicant can specify here the purpose in written form) - (Housing)

- Home enhancement - (Non-Housing)

- Educational expense - (Non-Housing)

- Health and wellness - (Non-Housing)

- Livelihood - (Non-Housing)

- Desired Loan Amount

Then the applicant is asked to choose what amount of loan will be suitable for them and satisfy their needs. These are the fields offered:

- Max of 60% (24-59 mos.)

- Max of 70% (60-119 mos.)

- Max of 80% (at least 120 mos.)

- Other Purpose (the applicant can specify here the purpose in written form)

- Bank Details

In order for the government to send over the loan, the applicant’s account details are being asked here. The required information is about the payroll account and the name of the bank.

What Are the Standard Uses of Pag-ibig Loan Form?

Pag-ibig Loan form is primarily used for requesting a loan from the government to fulfill expenses. These loans are allowed to people who have suffered from calamity or disasters.

- Minor home improvements

- Capital for a small business

- Tuition fees and other education-related expenses

- Purchase of furniture, appliances, or electronic gadgets

- Payment of utility and credit card bills

- Vacation and travel

- Special events

- Car repair

Who Needs a Pag-ibig Loan Form?

Anyone who requires financial assistance from the government will need a Pag-ibig Loan Form 2021 to apply for the said loan. This financial assistance can be required for several reasons, such as a homeowner looking to make necessary repairs.

These repairs can be anything ranging from plumbing to electrical wiring. The only requirement is that it must be specified on the form.

This personal loan is also great for people who don’t have equity in their homes. Since these loans also don’t require a house as collateral, they are a win-win situation for the applicant.

- Health and wellness

Although medical care should be a necessity, it’s a luxury only a few can afford in some areas of the country.

Small checkups are usually no big deal, but when surprise events happen, such as a loved one’s funeral, the cost of burying a loved one would approximately be $7,640. So it’s not hard to understand why several families won’t be able to pay such a vast amount.

Treatment of chronic diseases is another example where lots of funding is required in order to keep the patient healthy. In such cases, a Pag-ibig Loan Form can be a great source of help.

- Purchase of appliance and furniture/ electronic gadgets;

Electronic appliances are also another reason where one may request a loan. Appliances such as dryers are a must-have in many households. However, the steep prices of such devices deter several from spending the already limited budget.

This can even save the applicant money in the long run, as when an appliance is missing, people often resort to more expensive alternatives such as taking clothes to a private business. To avoid such costly losses, a personal loan is a suitable place to go.

- Vacation/ travel

One can even take out a personal loan for a vacation or a honeymoon. Most can’t afford these luxuries on their regular salary so that private loans can help people out.

However, it’s not advised to take out a Pag-ibig Loan only for a vacation as it would not only make your application less likely to be accepted, the interest to pay on that application would exceed the benefits one might receive from such a vacation.

- Car repair

If someone’s car has broken down, it will not only hinder their work, such as going to the workplace, bringing groceries, etc. But the alternative will also cost a lot, such as hiring a private taxi in places where public transport is not available.

Other Pag-ibig Loan Form Resources

Here are some government resources to follow to learn more about Pag-ibig Loan 2021 form. Here you can also find the digital version of the form itself, which can either be printed and filled or digitally completed through a computer.

https://www.pagibigfund.gov.ph/index.html

http://hr.ctu.edu.ph/hr/HRForms/PAGIBIG/pagibigLoanAppForm.pdf

http://lnhs.depedligaocity.net/downloads-forms/MultiPurposeLoanApplication_V03.pdf